PDF Publication Title:

Text from PDF Page: 008

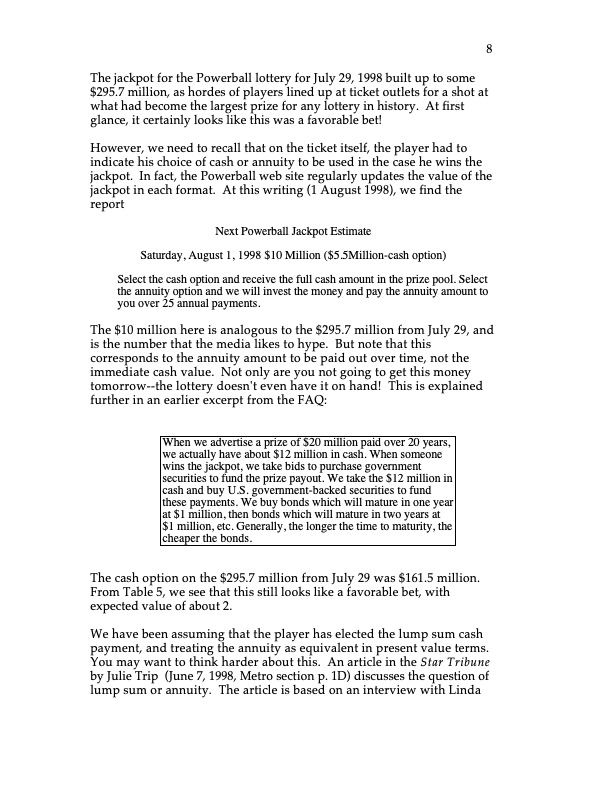

The jackpot for the Powerball lottery for July 29, 1998 built up to some $295.7 million, as hordes of players lined up at ticket outlets for a shot at what had become the largest prize for any lottery in history. At first glance, it certainly looks like this was a favorable bet! However, we need to recall that on the ticket itself, the player had to indicate his choice of cash or annuity to be used in the case he wins the jackpot. In fact, the Powerball web site regularly updates the value of the jackpot in each format. At this writing (1 August 1998), we find the report Next Powerball Jackpot Estimate Saturday, August 1, 1998 $10 Million ($5.5Million-cash option) Select the cash option and receive the full cash amount in the prize pool. Select the annuity option and we will invest the money and pay the annuity amount to you over 25 annual payments. The $10 million here is analogous to the $295.7 million from July 29, and is the number that the media likes to hype. But note that this corresponds to the annuity amount to be paid out over time, not the immediate cash value. Not only are you not going to get this money tomorrow--the lottery doesn't even have it on hand! This is explained further in an earlier excerpt from the FAQ: When we advertise a prize of $20 million paid over 20 years, we actually have about $12 million in cash. When someone wins the jackpot, we take bids to purchase government securities to fund the prize payout. We take the $12 million in cash and buy U.S. government-backed securities to fund these payments. We buy bonds which will mature in one year at $1 million, then bonds which will mature in two years at $1 million, etc. Generally, the longer the time to maturity, the cheaper the bonds. The cash option on the $295.7 million from July 29 was $161.5 million. From Table 5, we see that this still looks like a favorable bet, with expected value of about 2. We have been assuming that the player has elected the lump sum cash payment, and treating the annuity as equivalent in present value terms. You may want to think harder about this. An article in the Star Tribune by Julie Trip (June 7, 1998, Metro section p. 1D) discusses the question of lump sum or annuity. The article is based on an interview with Linda 8PDF Image | USING LOTTERIES IN TEACHING A CHANCE COURSE

PDF Search Title:

USING LOTTERIES IN TEACHING A CHANCE COURSEOriginal File Name Searched:

using_lotteries.pdfDIY PDF Search: Google It | Yahoo | Bing

Cruise Ship Reviews | Luxury Resort | Jet | Yacht | and Travel Tech More Info

Cruising Review Topics and Articles More Info

Software based on Filemaker for the travel industry More Info

The Burgenstock Resort: Reviews on CruisingReview website... More Info

Resort Reviews: World Class resorts... More Info

The Riffelalp Resort: Reviews on CruisingReview website... More Info

| CONTACT TEL: 608-238-6001 Email: greg@cruisingreview.com | RSS | AMP |